Leverage Meaning in Forex

Leverage is nothing more or less than using borrowed money to invest. Leverage is expressed as a ratio such as 12 or 150.

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

Forex Leverage A Double Edged Sword

In CFD trading the Ask also represents the price at which a trader can buy the product.

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

. Before you engage in trading foreign exchange please make. This is how you avoid being forced to accept or deliver 100000 euros. The more it borrows the less equity it.

Use our forex glossary to get adjusted to the common words phrases and terms used by other forex traders. It is very important to understand the meaning and the importance of margin the way it has to be calculated and the role of leverage in margin. CFDs are complex instruments due to leverage retail accounts lose money.

Forex FX is the market in which currencies are traded. While it can lead to payoffs there are risks involved. Forex Trading Apps.

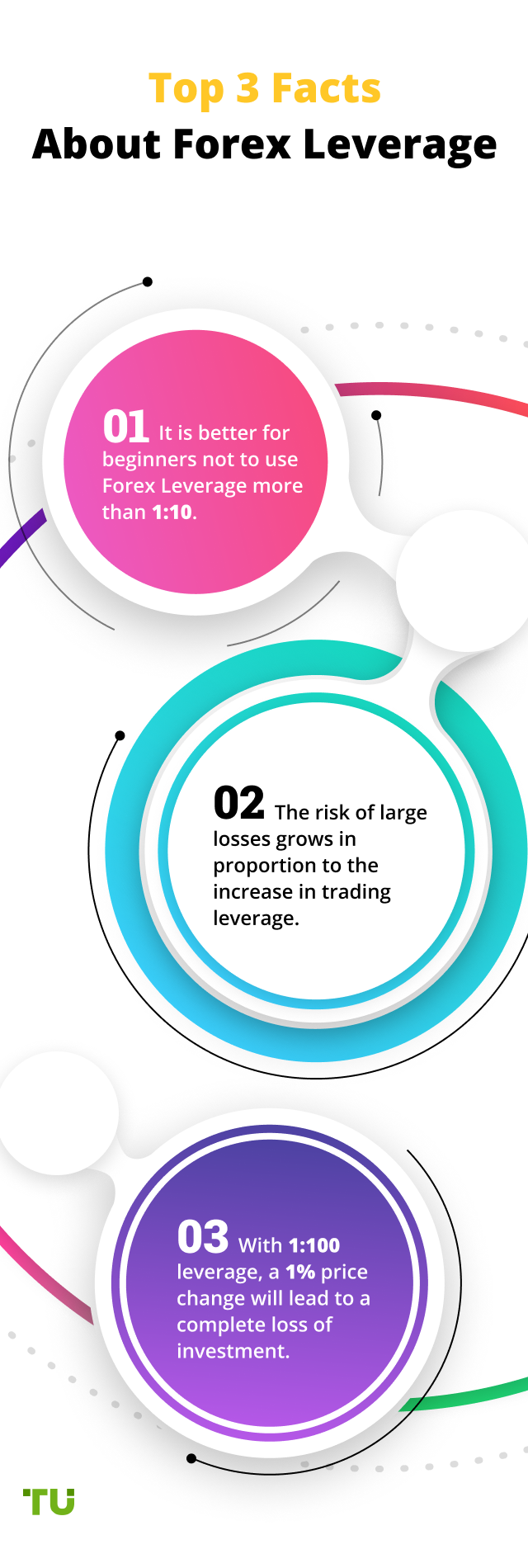

Forex signals providers will do all of the research beforehand meaning that traders who work full-time jobs or just dont have. No active negotiation of meaning with the writer producer or speaker. At this point you should be hugely aware that trading with leverage is a double-edge sword.

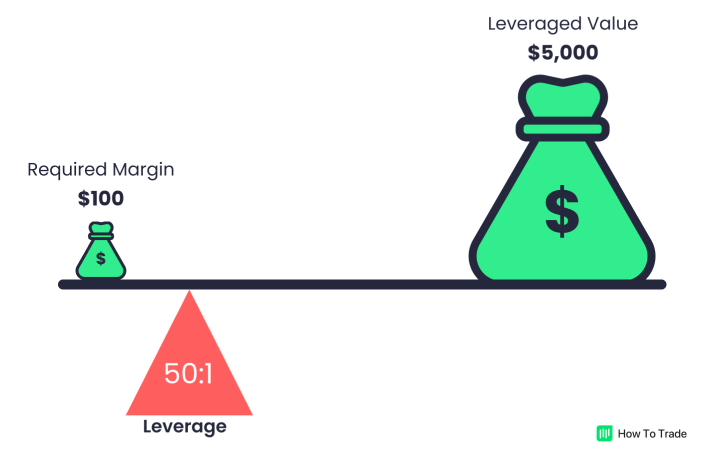

Margin and leverage are two important terms that are usually hard for the forex traders to understand. Leverage trading is trading on credit that lets you put a smaller amount down. Some brokers may have higher requirements.

Forex - FX. Leverage is the investment strategy of using borrowed money. We couldnt create a forex trading PDF without mentioning leverage.

Though not actually a cost to you the. When you trade CFDs you do so with leverage - meaning you can win or lose a significant amount more than your initial deposit - called your margin. Although your profits may be amplified your losses are also amplified.

Forex and CFD trading involves significant risk to your invested capital. Leverage Trading in Forex. Equity owners of businesses leverage their investment by having the business borrow a portion of its needed financing.

NDD meaning in Forex Brokers you get access to an interbank market and your positions executed automatically via the best available price while registered as an offset. No plausible means of engaging the masses. Leverage can arise in a number of situations such as.

Active negotiation of meaning between individuals. In the US the CFTC calls it a retail forex transaction. For example think about how often you hear someone say that the rain feels so good on my skin or that I love the smell of fresh snow.

Leverage and margin are vital elements to understand when it comes to forex trading for beginners. In the quote USDCHF 1452732 the base currency is USD and the Ask price is 14532 meaning you can buy one US dollar for 14532 Swiss francs. Increasing leverage increases risk.

When a trader opens a position she deposits an initial investment amount to be leveraged to maximise trading exposure. Specifically the use of various financial instruments or borrowed capital to increase the potential return of an investment. In order for forex brokers to increase the number of trades available to its customers they need to provide capital in the way of leverage.

Reading Viewing and Listening texts. Its the forex broker that offers you this leverage so they use their own capital to open the trade meaning you can participate in the forex market. The forex market is the largest most liquid market in the world with average traded values that can be trillions of dollars.

Please read and ensure you fully understand our Risk Disclosure. Speaking Listening Reading and Writing are the main modes of conveying and interpreting messages. Businesses widely use leverage.

Leverage can be used to help finance anything from a home purchase to stock market speculation. You are a GAIN Capital customer and ForexTrader is an electronic service within the meaning of GAIN Capitals Customer Agreement. With over 5 trillion worth of currency being traded every day the Forex market is the worlds largest financial market.

Some might even offer higher leverage since its so much easier to open and close positions. Securities like options and futures are effectively bets between parties where the principal is implicitly borrowedlent at interest rates of very short treasury bills. Personification examples can be found everywhere from film to prose to poetry.

Leverage and margin are related but are not the same concepts. This extensive liquidity means most brokers are willing to offer leverage ratios as high as 1001. In order to understand what margin is in Forex trading first we have to know the leverage.

Read more about NDD MT4 via Wikipedia. Margin Leverage in Forex. The personification definition we have established so far is pretty basic but what makes it a literary device.

When a spot forex transaction is not physically delivered but just indefinitely rolled forward until the trade is closed it is known as a rolling spot forex transaction or rolling spot FX contract. Most of the time when you trade the forex markets youll be utilising leverage. Federal regulations set the minimum margin requirement at 50 meaning you can borrow up to 50 of the price of a security you want to buy.

In other words leverage is the increased power to buy or sell financial instruments. Each of the forex trading platforms listed below has been pre-vetted meaning that you can be confident they tick most. Forex trading with IG Australia - set up a free account and you could start online Forex Market trading from just 06 pips on over 90 currency pairs.

This website is operated by Trading Point of Financial Instruments Limited registration number HE251334 with registered address at 12 Richard Verengaria Street Araouzos Castle Court 3rd Floor 3042 Limassol Cyprus. What is Personification.

The Relationship Between Margin And Leverage Babypips Com

No comments for "Leverage Meaning in Forex"

Post a Comment